The shift towards mandatory ESG reporting is reshaping how companies approach sustainability and transparency. As regulations tighten globally, organisations must prepare for increased scrutiny regarding their environmental, social, and governance practices.

The requirement for detailed ESG disclosures can overwhelm companies, particularly smaller firms that may lack the resources to manage extensive reporting requirements. This compliance burden can lead to failures if not adequately addressed. Furthermore, companies often struggle with the accuracy and consistency of the data they need to report. Incomplete or unreliable data can undermine the credibility of ESG reports, potentially causing reputational damage.

With mandatory reporting comes heightened legal exposure; companies may face litigation risks if stakeholders perceive their disclosures as misleading or insufficient. As reporting becomes standardised, stakeholders will demand more detailed and actionable insights, compelling companies to adapt to these evolving expectations or risk losing investor confidence.

While mandatory ESG reporting enhances transparency and accountability, it also presents significant challenges that organisations must navigate.

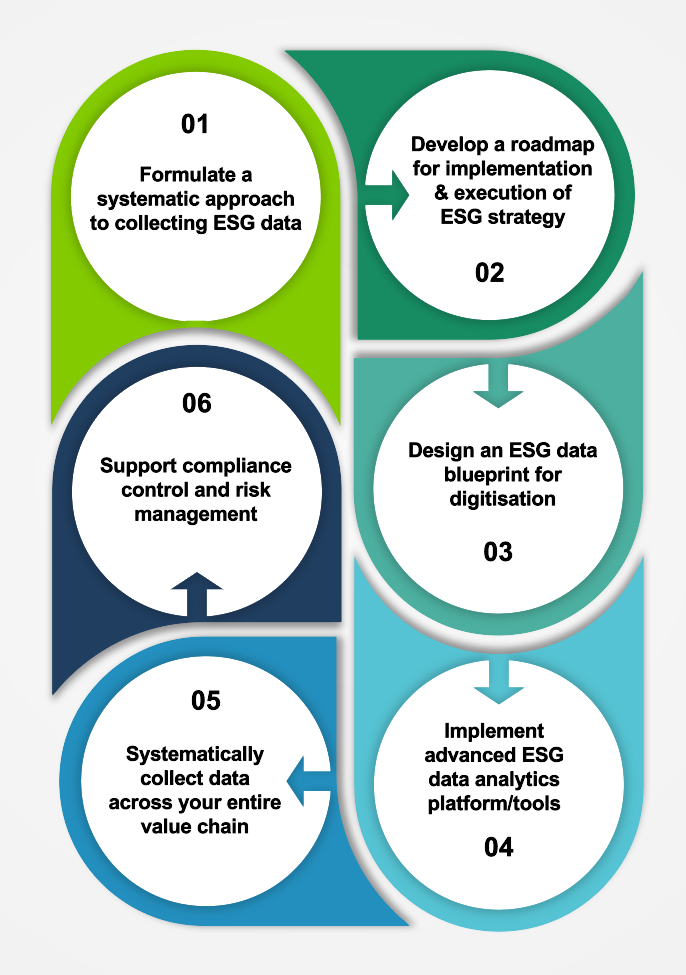

Companies need to invest in robust data management systems and compliance strategies to effectively meet these new requirements.

The transition to mandatory ESG reporting is a necessary evolution in corporate responsibility. It not only fosters greater accountability but also encourages businesses to adopt sustainable practices that benefit both society and the environment. However, it is crucial that support mechanisms are put in place to assist firms in meeting these requirements without compromising their operational viability.

Consider, as part of an organisation’s approach to meeting the ongoing and increasing ESG reporting requirements, the importance of collaboration with industry experts and investing in automated data collection technologies. This approach will not only streamline an organisation’s ESG reporting processes but also enhance data accuracy and reliability, ultimately positioning organisations for success in a rapidly evolving regulatory landscape.

As reporting becomes standardised, stakeholders will demand more detailed and actionable insights, compelling companies to adapt to these evolving expectations or risk losing investor confidence. Elevate your reporting standards today and secure your organisation’s success!